tax return rejected ssn already used stimulus

Weve filed over 50 million tax returns with the IRS. Irs rejected return ssn already used.

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

September 23 2020 938 PM.

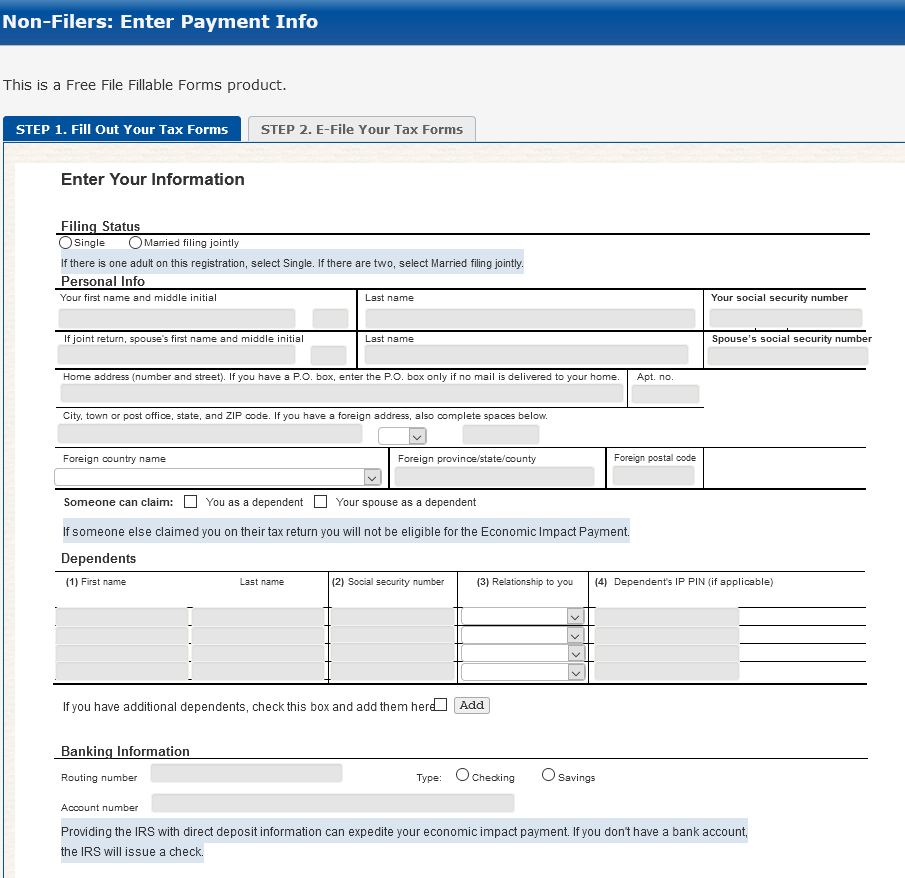

. My electronic tax return. 0 views 0 likes 0 loves 0 comments 0 shares Facebook Watch Videos from Piscataway NJ Home Values. If you used the IRS non-filer site to get a stimulus check you will now get a duplicate SSN rejection.

I was instructed after calling the practitioner priority line to file an amended return for a client whose e-file was rejected due to a duplicate SSN. We are seeing people who did not notice or ignored the. What do I do now.

During this process your refund will be frozen. The root of the problem is that the. Well help you get the biggest refund the fastest way possible.

The irs will in some cases contact taxpayers using the. I filed electronically and my tax return was rejected. McLain Realty Team Latest Info.

If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return. SSN has been used on a previously accepted return. If you are experiencing significant financial hardship due to the freezing of your refund the IRS Taxpayer Advocate Service can.

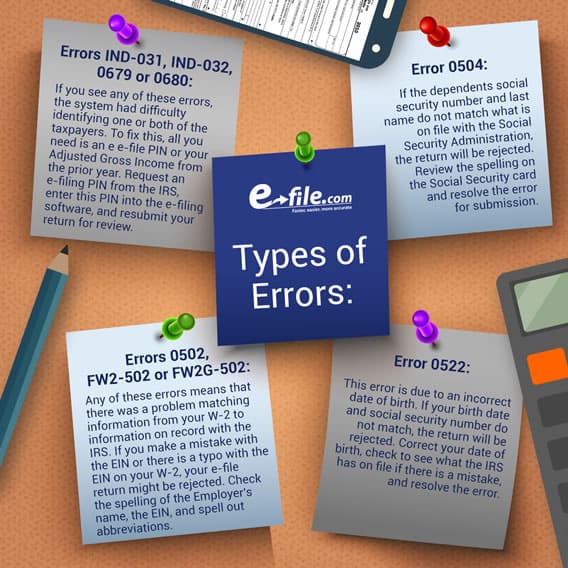

My 1040 was rejected with code R0000-502-001. Get Your Maximum Refund. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Well be filing an original joint Form 1040 series tax return. If youre ready to buy your first home your tax. A few weeks ago I entered my info for a non-filer so I could change my bank.

Can we file our return electronically. In most cases the taxpayers social security number ssn was entered incorrectly. Whether the cause of this rejection is the result of a typo on another.

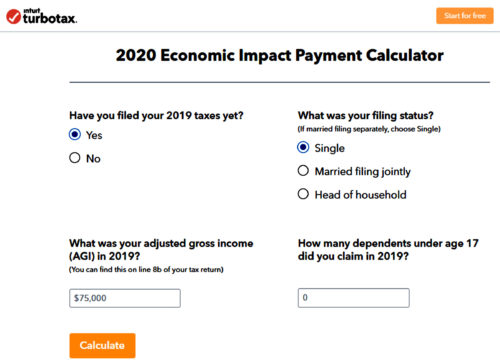

Rejected due to SSN already used. This morning I received an email stating that my tax return was rejected due to my SSN already being used. The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate 1200 Economic Impact Payments to Social Security recipients who did not file tax.

January 30 2020 826 PM. I know I have not filed previously this year.

How To Find Out If Someone Has Filed Taxes In Your Name

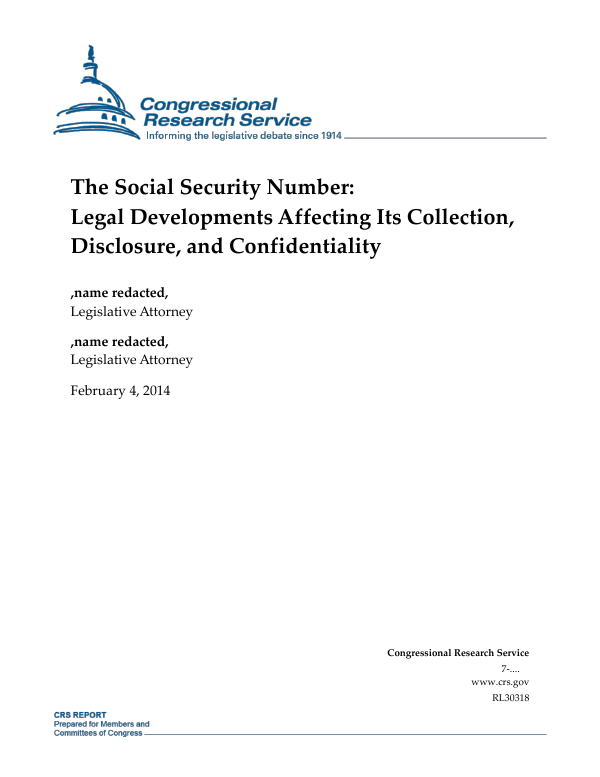

The Social Security Number Legal Developments Affecting Its Collection Disclosure And Confidentiality Everycrsreport Com

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Video What To Do If Your Tax Return Is Rejected By The Irs Turbotax Tax Tips Videos

Rejected Tax Return Common Reasons And How To Fix

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Tax Return Rejection Codes By Irs And State How To Re File

Irs Where S My Refund Refund Status Reference Error Codes

Non Filers Form Initially Rejected R Stimuluscheck

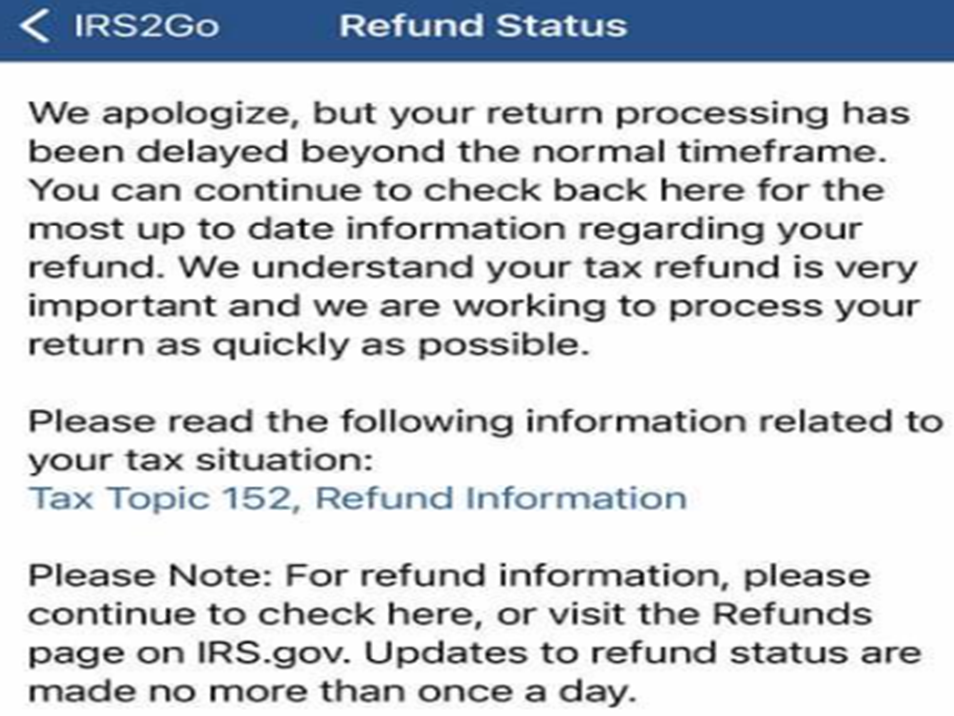

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Register For Your Stimulus Payment Free Easy Online Cares Act

Someone Used My Social Security Number To File Taxes What Do I Do

Rejected Return Due To Stimulus H R Block

Fraudulent Tax Return And Identity Theft Prevention Steps

Your Tax Return May Get Rejected If Last Year S Filing Is Pending

Possible Rejection Reasons When E Filing Taxes E File Com

Are Irs Security Tools Blocking Millions Of People From Filing Electronically